In truth, investors don’t decide to buy properties they decide to buy the income streams of those properties. It is an income stream generated by the operation of the property, independent of external factors such as financing and income taxes. As heartless as it may sound, a real estate investment is not a felicitous assemblage of bricks, boards, bx cables and bathroom fixtures. That market value is a function of its “income stream,” and NOI is all about income stream. Why all the nitpicking? Because NOI is essential to apprehending the market value of a piece of income-producing real estate. Subtract the Operating Expenses from the Gross Operating Income and you have the NOI.

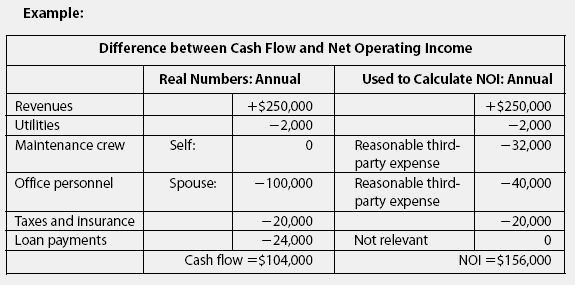

You may need a mortgage to afford the property, but not to operate it. Your mortgage interest may be a deductible expense, but it is not an operating expense. Property tax is an operating expense, but your personal income-tax liability generated by the property is not. Repairs and maintenance are operating expenses, but improvements and additions are not – they are capital expenditures. Loan payments, depreciation and capital expenditures are not considered operating expenses.įor example, utilities, supplies, snow removal and property management are all operating expenses.

To be considered a real estate operating expense, an item must be necessary to maintain a piece of a property and to insure its ability to continue to produce income. Many people say, “If I have to pay it, then it’s an operating expense.” That is not always true. Operating Expenses: This is the term that causes the greatest mischief. The result is the Gross Operating Income. Subtract from this amount an allowance for vacancy and credit loss. In this case, take the Gross Scheduled Income, which is the property’s annual income if all space were in fact rented and all of the rent actually collected.

You need to peel the layers off one at a time. Gross Operating Income: Definitions are like artichokes. Let’s take these two new terms one at a time: We have now succeeded in confounding our readers and compounding their problem by replacing one undefined term with two. By more formal definition, it is a property’s Gross Operating Income less the sum of all operating expenses. You might think of NOI as the number of dollars a property returns in a given year if the property were to be purchased for all cash and before consideration of income taxes or capital recovery. With regard to investment real estate, however, the term, “Net Operating Income” is a minor variation on this theme and has a very specific meaning. NOI, as it is often called, is a concept that is critical to the understanding of investment real estate, so we are going to backtrack a bit and review that subject here.Įveryone in business or finance has encountered the term, “net income” and understands its general meaning, i.e., what is left over after expenses are deducted from revenue. We may have gotten a bit ahead of ourselves, since some of our readers were unclear on the precise meaning of Net Operating Income. Our discussion concerned the relationship among three variables: Capitalization Rate, Present Value and Net Operating Income. In a recent article, we discussed the use of capitalization rates to estimate the value of a piece of income-producing real estate.

0 kommentar(er)

0 kommentar(er)